How to Build Wealth?

We can define wealth in different ways, but for the purpose of this post we are going to define it as the state of being rich. It’s true that every personal finance guru out there has there own view of things and their own sales pitch. However, I’m not going to make an argument for any of them on this post. I will tell you what I have learned after following them for many years.

Knowing Yourself

Yes, you need to know yourself and what is it that you want to accomplish in life. What is important for you and what do you want to leave as a legacy. Maybe those are really philosophical questions, but everything starts from there. The rest is like Dave Ramsey says: “It’s 20% knowledge and 80% behavior”. Words like: focus, patience and discipline are very important in life, but more important in the world of personal finances and investing. After you have decided what is it that you want to do (goals/legacy) it will take focus, patience and discipline to get there.

Time Value of Money

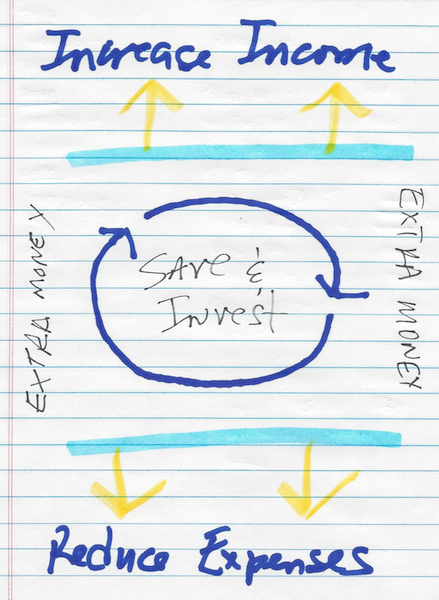

There is a core principle in finance that is called Time Value of Money. In layman’s term, Time Value of Money says that provided money can earn interest, any amount of money is worth more the sooner it is received. In other words, the sooner you start paying consumer debt, saving and investing money the better off you will be in the future. In order to do that, you need to increase your income, reduce your expenses, then save and invest the rest.

Sounds very easy, but believe me, it’s not. That is where knowing yourself comes into play and how serious and determined you are in achieving your goals.

Educating Yourself

This is the most vital part of the strategy. You need to know where to invest before you start investing. There are a many school of thoughts on this topic. There are a many approaches and strategies, but once you start getting some knowledge you will know which one fits your goals. Learning about human behavior and behavioral economics is a must.

Actionable Items

- Increase Your Income

- Reduce Expenses

- Have a Debt Reduction Plan

- Save and Invest

- Educate Yourself

Summary

The best investment that you can do is in Yourself. Once you start learning about personal finances, investing, history, human behavior and other topics you will see how a world of opportunities starts to open. The more you learn, the more you earn.